Behind the Curtain

The PERS they don’t want you to see

By Jesse Villarreal Jr.

For years, the officials at Oregon’s Public Employees Retirement System (PERS) have marketed

their retirement plan as one of the best in the country. Oregon’s governors, legislators, judges,

and even the attorney general’s office have kept everyone from looking too deeply into their

sacred plan. Fifty years of rule and benefit enhancements by a self-governed plan have produced

one of the most expensive, complex and questionable pension plans in existence.

As members prepare for retirement, getting straightforward answers to simple questions from

PERS is difficult at best. Rank and file members such as teachers and police officers do not

receive clear, concise, consistent, accurate, or timely information regarding their life savings.

Deciphering any one of the 14 retirement options available can be overwhelming. Trying to

calculate retirement benefits using the myriad retirement formulas requires advanced mathematic

skills and cannot be relied upon. Members are urged not to examine their options and are

encouraged to stay within the plan even as their life savings erode due to mismanagement.

One of the first questions that every member asks is, “If PERS manages our life savings so well,

then how can we be billions in the hole?”

No matter how the fund performs, if benefits are continually raised without a means for paying

for them, the plan will implode. Think of Whimpy from the old Popeye cartoon: “I’ll gladly pay

you Tuesday for a hamburger today.” Some politicians and union leaders have successfully

duped PERS members and the public with this old trick, knowing they wouldn’t have to deliver

on their promises until they were long gone. They were elected, dues were collected, and

members were forgotten.

During the past legislative session lawmakers were often overwhelmed by the complexities of

PERS, and they were misled by lobbyists and special interest groups. They were denied critical

information and were unable to make unbiased, informed decisions. Worst yet, they were simply

pressured into voting along party lines.

Contrary to popular opinion, the bear market from 2000 to 2002 did not bring PERS down. Nor

did the reforms from 2003 fix PERS. The $5.5 billion in debt issued over the last couple of years

to pay off employers’ PERS liabilities has yet to be repaid, but rather the debt has been passed on

to our children and their children. How will the PERS board handle the additional $2.7 billion in

Unfunded Accrued Liability? Can we trust PERS math? The misinformation machine built for

PERS continues to keep 300,000 members pitted against the 3.3 million Oregonians who aren’t

members. Both groups are kept in the dark.

The Retirement Information Management System (RIMS) is the information technology that

PERS has relied on since the mid-1980s, which according to PERS, “…employs outdated and

highly inflexible technology.” The following is from the PERS Members Handbook:

RIMS has proven unable to cope with the expansion and substantial revisions to PERS in the last

15 years. As a result, approximately 35 to 40 percent of the agency’s processes must be done

manually. This invites higher error rates, generates higher costs, degrades productivity, and

lowers the quality of service provided to members and employers. As the RIMS system ages, the

agency has found it particularly difficult to adapt to program changes required of PERS due to

legislative action or new Board policies. Nor is it easy to produce information from RIMS to aid

decision makers at any level who might be considering additional changes or issues affecting

PERS. Though all of the effects noted above adversely affect PERS’ stakeholders across the

board, there is no evidence that RIMS’ problems in any way threaten the financial viability of

PERS.

PERS has been granted a monopoly on Oregon’s public employees’ retirement savings. In the

last three years alone, the PERS board has taken an additional $30 million of PERS members’

and taxpayers’ money to shore up RIMS. If PERS were held to the standards of private pension

plans, all Oregonians could have saved this huge expenditure and more. How? Competition. By

utilizing successful, experienced institutional money managers that manage and administer

public employees’ pension plans for other states, employers’ rates would drop dramatically.

Returns would be competitive, members would be able to control the amount of risk they are

subjected to, and they could gain much needed access to information to make informed

decisions.

The strong returns reported by the Oregon Investment Council (OIC) are the most common

argument for keeping members in PERS. The OIC is a small group of individuals hand selected

by the governor to oversee approximately $55 billion in public retirement funds. One of the main

problems, besides conflict of interest concerns, is the difficulty members have in accessing

accurate or timely information regarding the amount of risk associated with their life savings.

For example, Tier One members, those hired prior to January 1996, have two investment options.

A Regular Account with a guaranteed assumed rate currently set at 8 percent and a Variable

Account that fluctuates in value based on the investment returns. According to an actuarial study

presented in front of Judge Brewer in Multnomah County Court in late February/early March

2004 for the period of 1978 to 2002, the PERS board credited a compound 11.95 percent to Tier

One members’ accounts. The problem? The fund only earned a compound 11.59 percent. At first

glance, the roughly one-third point difference does not seem significant; however, over a period

of 25 years the difference is substantial considering the market does not move in a straight line.

When the actuary was asked why the board would have done this, he replied, “They didn’t know

what they were doing.”

During the 1990s everybody wanted to be in the stock market and the PERS board encouraged

its members to do so. The board had given its members discretion to contribute 25, 50 or 75

percent of their monthly contributions into the Variable Account. The same actuary was asked to

compare the risk of the Regular Account to the Variable Account. He concluded the Variable

Account was two-and-a-half times riskier than the Regular Account for less than a one

percentage point improvement in returns. The actuary said the Variable Account was a “terrible

deal” for members.

Had members or employers been privy to the above information, members’ account balances

would not have lost money and they could have avoided being subjected to so much risk. In

addition, employers’ rates would have been held within acceptable levels without taking much

needed funds away from education, social services and healthcare.

Lacking transparency or accountability, PERS has continued to run rampant. The newest

retirement plan as a result of the so-called 2003 reforms is the Individual Account Program

(IAP). Oregonians have again been misled with another time bomb. The PERS board and some

members of the legislature were quick to dub the IAP a 401(k)-style plan. Unfortunately, the IAP

is no 401(k). It is expensive and highly restrictive. Members have no investment options and

have been denied the right to control the amount of risk they are subjected to.

PERS issued up to 170,000 erroneous IAP member statements last year claiming members

received up to three times the actual return performance. PERS Executive Director Paul Cleary

and Deputy Director Steve Delaney were both caught misinforming the Senate Rules Committee

chaired by Sen. Kate Brown. When asked if PERS was taking the interest and earnings during a

30-45 day float period (the time between when money is contributed from a member’s paycheck

to the time it is invested in their IAP), both directors initially insisted that was not PERS practice.

But under questioning later they confessed to PERS keeping nearly $700,000 of members’

money for the first half of the year alone. When further pressed, both directors changed their

story again regarding the discrepancy between actual returns versus stated returns.

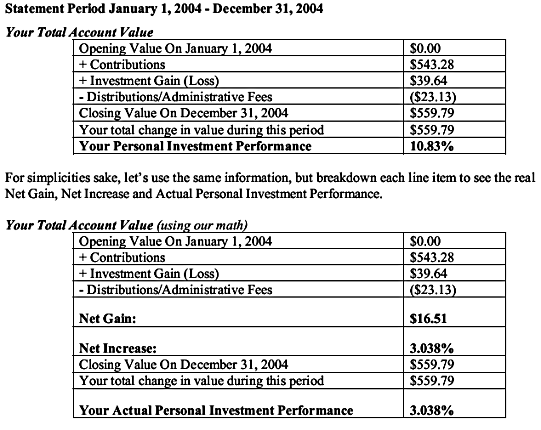

The chart below is based on an actual member’s IAP statement from PERS:

The force to keep this information behind the curtain is overwhelming. Members are scared and

concerned about severe retaliation if they break rank. Only after testimony at one of Sen.

Brown’s Senate Rule Committee hearings did word leak from a lobbyist (name withheld for fear

of career-ending punishment) who participates in the IAP. This lobbyist confessed to being

instructed to block any efforts to improve PERS. Why come forward now? “We checked the

math on our IAP statements. It is misleading and absolutely wrong.”

To date, members have not been informed regarding these discrepancies nor have they received

corrected statements. In addition, at no point did Sen. Brown stand up for members, taxpayers,

schools, social services, or healthcare by questioning the two PERS directors regarding these

discrepancies even after they had been caught attempting to mislead her Senate Rules

Committee. Neither PERS nor its directors have yet to receive even a slap on their collective

wrists for misleading a senate committee and PERS members who entrust them with their life

savings.

These and many other inconsistencies at PERS cannot and should not continue. The PERS

system should be efficient, transparent, accountable, competitive, and cost effective for all

involved. Senate and House bills proposed during the past legislative session would have

improved the system had it not been for Gov. Kulongoski’s firm stance against fixing PERS with

more than a fresh coat of paint. Left unchecked, PERS costs will expand exponentially while

simultaneously draining our schools, social services and healthcare systems. After three years of

research and extensive study into public employee retirement plans across the country, it is clear

that we can fix PERS without dismantling the entire system or breaking promises for benefits

earned.

Back room deals and closed-door meetings must end. Members and the public must say “no

more” to special interest groups and lobbyists for organized labor who prohibit members and the

general public from seeing the real PERS. The governor must stand up for members as well as

education, social services and healthcare. We cannot afford to continue to burden our children

and our children’s children with a retirement plan filled with loopholes and abusive practices for

the well-connected. PERS members must be given the information necessary to protect their life

savings from a board that has a free hand to subjectively change rules at will without any

ramifications or repercussions for their actions.

If you care about Oregon, about schools, about social services, about health care, or just about

your own pension, then get informed. Get involved. Insist PERS be competitive, transparent and

held accountable.

Jesse Villarreal Jr. is the founder of PERS Help, a nonprofit organization that has spent years

researching and studying the PERS system and other retirement systems across the country and

providing free access to information for Oregon PERS members. He can be reached at

jesse@pershelp.com.

BrainstormNW - May 2006

|